Key Points

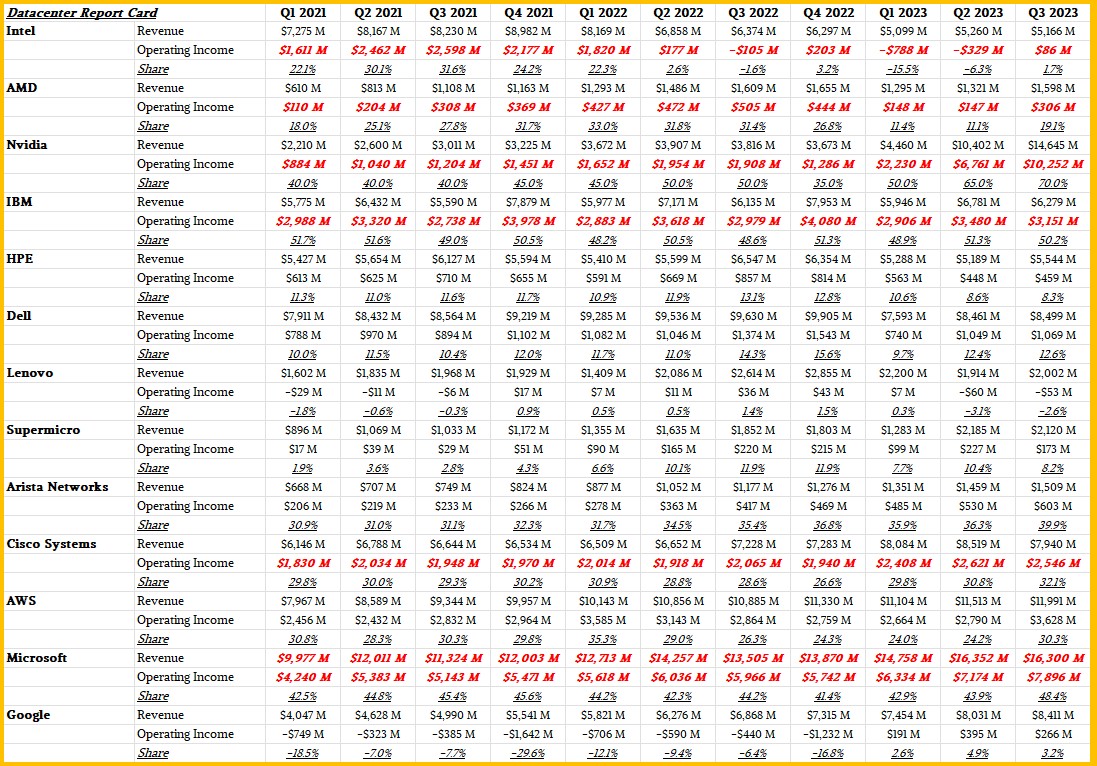

- The Datacenter Infrastructure Report Card is a model that compares the quarterly financial performance of the key suppliers in the datacenter market, covering compute engine chips, OEM systems, storage and core systems software, datacenter networking, and cloud infrastructure capacity.

- The model is based on the revenue and operating profit figures provided by the vendors or estimated by the authors, and does not assign letter or number grades to the vendors.

- The model aims to show the trends in cloud and on-premises spending and the relative strengths and weaknesses of the vendors in the datacenter space.

- The model includes some adjustments and assumptions to align the vendors’ quarters and to separate the core systems sales from the middleware and tools sales for Microsoft.

- Datacenter revenue and operating profit of thirteen vendors across four categories: compute engine chips, OEM systems, storage and core systems software, datacenter networking, and cloud infrastructure capacity.

- Datacenter revenue and operating profit of thirteen vendors across four categories: compute engine chips, OEM systems, storage and core systems software, datacenter networking, and cloud infrastructure capacity.

- Trends and challenges for each vendor, highlighting the impact of the large language model (LLM) revolution on the system architecture and the market dynamics.

- Advantages and disadvantages of having a full stack or a thin stack in the datacenter, and the role of supercomputers and ODMs in the industry.

It is hard to keep a model of datacenter infrastructure spending in your head at the same time you want to look at trends in cloud and on-premises spending as well as keep score among the key IT suppliers to figure out who is winning and who is losing. And so we have built a model that does this, and we are calling it the Datacenter Infrastructure Report Card.

We are not going to be delivering letter or number grades to vendors, because money is how you keep score and that is the only metric that matters in any market in the final analysis. And specifically, we have lined up the quarterly results of the key suppliers in the datacenter – those that sell compute engine chips, OEM systems and related storage and core systems software, datacenter networking, and raw cloud infrastructure capacity – that make up the backbone of the datacenter these days.

This is meant to be fun as well as illustrative. We will continue to provide individual and detailed financial analysis for each other these companies (and others) but will bring the summary datacenter revenue and operating profit streams from these thirteen vendors across these four categories once the last of this group posts its financial results for any given calendar quarter.

Dell, Hewlett Packard Enterprise, and Nvidia have quarters that end at weird times, and we have placed their results for their most recent quarters into the third calendar quarter of 2023 to get everyone lined up on Q3. We realize this is imprecise, but there is no way to figure out how to cut up their quarters and allocate them to calendar quarters. These companies could do us all a favor and just have calendar quarters.

In many cases, vendors provide revenue and operating profit figures for their datacenter divisions. Sometimes they do not provide revenues for datacenter sales and we have to estimate them (as we have long done with IBM and Intel, for instance, call it their “real” systems businesses, for instance). Sometimes vendors do not provide operating income for their datacenter divisions and we have to take our best guess at allocating operating profit or loss from the overall company to the datacenter products. Anything in the table below marked in bold red italics is estimated.

Microsoft, for instance, is all in red in our model, but that does not mean it is a wild guess. Big Bill has a division called Intelligent Cloud that includes Windows Server, SQL Server, Visual Studio, and other middleware and tools sold into the datacenter, including compute, storage, and networking capacity on the Azure cloud and related platforms and SaaS services Microsoft peddles into the datacenter.

We looked up market studies about database management system revenues and share for Microsoft, and the same for application development tools, and backed this out of the Intelligent Cloud revenue stream to arrive at what we think of as Microsoft’s core systems sales across on premises and Azure. We allocated operating income proportionally to revenue because we have no better guide, and we think that profits from the Windows Server stack go a long way to cushioning the blow to operating income from massive investments in infrastructure for Microsoft. Which is something Google does not have and that Amazon Web Services only has a bit of. You will no doubt see this in the numbers.

We have no easy way to extract the Windows Server platform revenue stream from the Azure cloud revenue stream, and so we have left them together for Microsoft in the cloud infrastructure supplier comparison charts. We reckon at this point, about half of the core systems part of the Intelligent Cloud business is for on premises Windows Server and the other half is for raw cloud infrastructure – that is a valid guess based on market trends, but a guess. But arguably, half of Microsoft’s revenues and profits could be considered in the OEM systems camp and half in the cloud camp.

We think these vendors are representative for key trends, but realize they are not the totality of the market. But they do show who is making revenue and who is getting to keep how much money.

Here’s the big table of datacenter revenue and operating profit for the Thundering Thirteen:

Maybe you are like a large language model and you can take that all in at once, but we need to chew on it with little bites. Let’s look at the three key compute engine makers – Intel, AMD, and Nvidia – first. Take a gander at this:

![]()

Read More at: The Next Platform

TAGS CLOUD NVIDIA IBM AMD INTEL Granite Rapids Falcon Shores accelerator that comes out after 2025 Datacenter Infrastructure