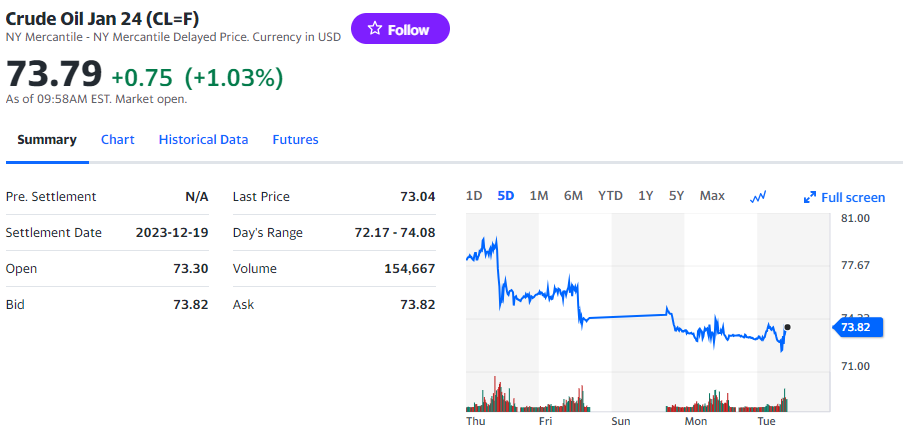

Crude oil futures closed lower Monday for the third straight session, as analysts said the oil market has decided OPEC+’s voluntary production cuts are not going to have much of an impact.

“Oil has become a ‘show me’ type market,” RBC analysts Michael Tran and Helima Croft said, with the near-term path of least resistance moving lower, “given the degree of ambiguity and lack of catalysts.”

Now comes the hard part: “Prices will likely remain volatile and potentially directionless until the market sees clear data points pertaining to the voluntary output cuts,” Tran and Croft wrote.

“With markets seemingly anticipating more of an economic slowdown next year, the announcement simply doesn’t go far enough,” OANDA analyst Craig Erlam wrote. “It’s another large cut but how much will actually be delivered on? And are we at the limits of what the alliance is willing to achieve to balance the markets?”

Crude prices rose briefly after Saudi Energy Minister Prince Abdulaziz bin Salman told Bloomberg that the country’s production cuts “absolutely” could continue past March, but the gains rapidly faded, highlighting the market’s pessimism.

Ballistic missiles fired by Yemen’s Houthi rebels hit three commercial ships Sunday in the Red Sea, and a U.S. warship shot down three drones in self-defense, but oil prices remained largely unaffected as fears of a broader conflict faded.

In This Post

Brazil to join OPEC+ but won’t cap oil output, Petrobras CEO says

RIO DE JANEIRO, Dec 1 (Reuters) – Brazil is expected to join the OPEC+ group of oil-producing countries in January but would not take part in the group’s coordinated output caps, the chief executive of state-run oil firm Petrobras (PETR4.SA) told Reuters.

MarketWatch: Oil futures mark back-to-back losses with traders skeptical of OPEC+ output cuts

Oil futures finished lower on Friday for a second session in a row. Traders looked to a decision by OPEC+ to cut production further in the first quarter with skepticism. “It seems traders either aren’t buying that members will be compliant or don’t view it as being sufficient,” said Craig Erlam, senior market analyst at OANDA. It could also be that the “lack of formal commitment hints at fractures within the alliance, which could impact its ability to hit its targets, let alone cut further if necessary.”

WSJ: Wall Street Shrugs Off Latest OPEC+ Oil Cuts: Investors wary that Saudi-led group won’t stay on the same page in 2024

WTI Crude Oil Technical Analysis

The West Texas Intermediate Crude Oil market

continues to be very choppy as we try to sort out what we are going to do next. After all, OPEC is in the process of debating whether or not they should be cutting production, as prices have been slashed. Furthermore, we also need to keep in mind that there are a lot of questions out there as to whether or not the markets are oversold, and of course whether or not they need help by OPEC cutting pricing.

One of the biggest negatives for the market is the fact that we could be heading into a major recession, and therefore it’s likely that we have less demand coming. That being said though, have we gone too far? I think that’s what we are trying to sort out now, and it looks like the $72.50 level underneath remains support, while the $79.50 level above offers resistance.

Brent Crude Oil Technical Analysis

Brent markets have also gone back and forth during the course of the trading session, as we continue to dance around the $80 level. With that being the case, I think you’ve got to look at this through the prism of whether or not we have enough demand, or whether or not we have dropped pricing enough to pick demand out. After all, if we head into a massive recession, it’ll be interesting to see whether or not the market can continue to go higher.

It’s worth noting that the 50-Day EMA is getting ready to break down below the 200-Day EMA, which is the so-called “death cross.” This is a negative technical indicator, but it is quite often late and therefore a lot of times you will see it right before the market turns back around. At this point though, I think a lot of what this comes down to is what OPEC decides. If OPEC gets extraordinarily aggressive with its production cuts, that could provide a bit of a lift. I do think that we are oversold, and now we are in what could be thought of as an accumulation phase, but we need to break above the $83 level to confirm that.

Source: Seeking Alpha OPEC OPEC+ Crude oil oil futures continue to decline voluntary production cuts Brazil Saudi Arabia Russia BRENT